The Indian Startups are a success story and must be cherished. There are 100 Indian Startups that are currently valued at over $1 billion. A decade ago, there was only one startup – InMobi which was valued at $1 billion but a decade later it has 100. It makes the Indian Startup Ecosystem, the fastest growing ecosystem in the world.

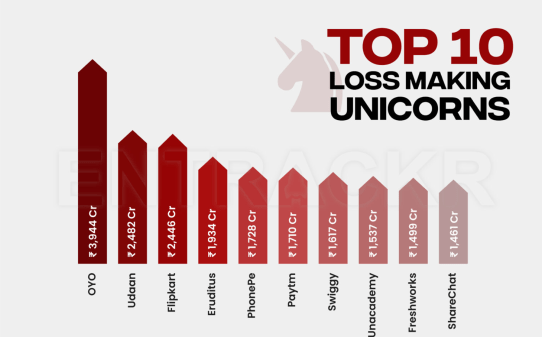

But there was only one problem. As Indian Startups grew, their profits did not increase as such. Even after a decade, some of these companies are still burning cash without reaching profitability. Indian Startups like PayTM and Zomato were listed on the stock market and got exposed. With no conclusive profits and growth, these companies have been set as an example for ‘huge cash burns’ and ‘no profits’!

With all this in mind, what lies ahead for the Indian Startups in the future?

More conscious Venture Capitalists

In US, companies (IT and Tech) listed on stock market suffered losses. Meta, Snap, Netflix have not only frozen the hiring but also fired its employees too. Venture capitalists now have a more conscious outlook for funding any major startups.

These days when companies talk about ‘value’, they do not talk about profitability and sustainability. Value is referred to as the ‘potential’ money they can create with the customer base into a possible market size. A lot of things are left on future possibilities rather than looking at the balance sheet. This definitely makes the market volatile and less predictable.

The aim of VCs while funding any startup is to get profits from it. For example, a VC expects to get 15 units in return when he/she invests 10 units into the company. After IPO failures, VCs would definitely be more conscious of how any Indian Startup is spending its money.

Wiser Retail Investors

Retail investors have suffered huge losses when they decided to invest in startups like Zomato and PayTM. They believed in these companies only to get disappointment in return. Imagine someone buying PayTM shares for 2,150 INR on its day of IPO and realising its value is reduced to 621 INR as of June 4, 2022.

Imagine someone putting it their hard earned money into a company they believe in but suffer losses. Rather than looking at the possible potential, it is important for retail investors to understand how companies utilise the money and possible strategies leading to sustainability.

Stricter SEBI Rules

SEBI (Securities and Exchange Board of India) gives approvals for IPO in India. Since companies are held privately before IPO, it is important for SEBI to inspect the valuations strictly. World renowned economists and financial bankers have overvalued the IPO and have shown concerns before, yet no actions have been taken. PayTM and Zomato valuation were overvalued and it is known to everyone yet not actions were taken.

With all these companies going public, it is important for the government to have a stricter scrutiny so that no money is lost.

Risk for Startup Employees

In a recent post from Inc 42, more than 1,700 startup employees have been impacted in the latest round of cutbacks at Trell, Unacademy, Meesho, Furlenco and other startups.

Unicorns and growth-stage startups are suffering the effects of carrying a large workforce without much thought being paid to sustainability and unit economics. The sad truth of a developing economy is eventually 100s of startups in a particular industry will fail and only 2-3 of them survive.

Easy example could be seen in the Telecom Sector in India. Idea, Vodafone, Uninor, Airtel, TATA Docomo, BSNL, MTNL, Reliance Communications, Aricel, MTS, Axiata Spice Communications, Telstra, S Tel, Videocon Telecom.

Do you find these names familiar? Well some of them got sold off, merged, got defunct as time passed by and only 2-3 players are left in this industry as of 2022.

As much as startups are exciting; startups are risky, not only for the founders but the employees in the long run too.

Nice!!